Empire Petroleum Corporation Secures $20 Million from Crossfirst Bank

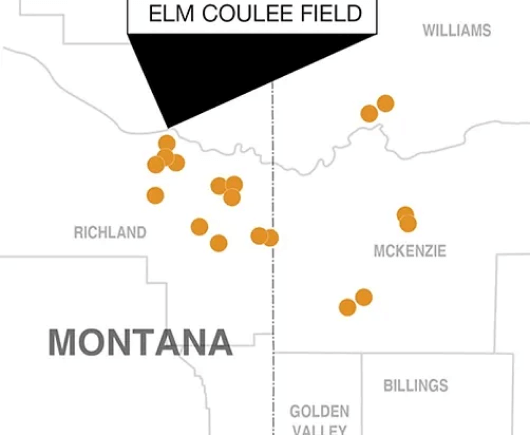

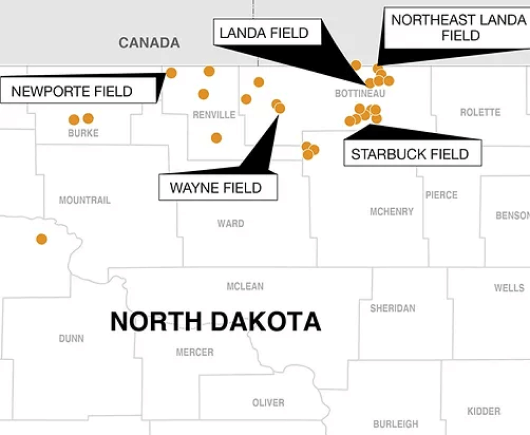

Empire Petroleum Corporation is a conventional oil and natural gas producer with a main focus in the US onshore. The Company possesses long-life, low operational cost, mature, producing assets with slow decline profiles in the Bakken region and central Gulf Coast region, in the states of North Dakota, Montana, Louisiana and Texas. Leveraging operational efficiencies, Empire focuses on economical well rehabilitation, stimulation, field maintenance and management to generate low-risk cash flows that provides stability and growth for shareholders. Through this very disciplined strategy, Empire embarked on a series of value-driven acquisitions.

In executing its growth strategy, Empire required reserved-based funding. Pritchard Griffin conducted a competitive process aimed at securing the highest possible advance rate and lowest cost of capital on Empire’s behalf. Our process ultimately resulted in Empire securing a $20 million facility with CrossFirst Bank in Tulsa.

In executing its growth strategy, Empire required reserved-based funding. Pritchard Griffin conducted a competitive process aimed at securing the highest possible advance rate and lowest cost of capital on Empire’s behalf.